Key Takeaways:

- Historical precedents, social narratives, and negative media coverage damaged Bitcoin’s reputation.

- Bitcoin doesn’t have widespread utility

- Bitcoin has a glaring regulation problem

Media narratives and personal antipathies made people wary

The first reason is reputational in origin.

Historically, crypto suffered numerous reputational blows thanks to bad actors like SBF, who used the medium for their fraudulent ambitions, or from very dubious NFT projects that ultimately used social hype to garner quick and dirty revenue.

Those faulty projects would either be exposed as Ponzi schemes or rug-pulls that exploited the artists who worked for them.

Alternatively, they would not be fraudulent by design but executed poor business, technical strategies, and decisions that couldn’t lead anywhere meaningful or sustainable in the long term.

And besides that, on numerous occasions, acclaimed investors like Warren Buffet and Charlie Munger expressed their lack or, should one say, the absence of trust in crypto and even started to question the concept and premise of cryptocurrencies as a whole.

The “Oracle Of Omaha,” Warren Buffett himself publically criticized and challenged crypto repeatedly, opting to call BTC a “gambling token” and even arguing that crypto doesn’t have “any intrinsic value” in itself.

BTC has limited utility

Another reason is that Bitcoin fails the utility test.

One of the factors that determine utility is volatility. A highly volatile currency cannot act as a stable medium of exchange or store of value. For example, according to an Investopedia article, Bitcoin is highly volatile.

In another article, Investopedia attributes Bitcoin’s high volatility to how supply and demand logic has a major say in why Bitcoin’s price has been highly mercurial.

The next factor is transferability, and Bitcoin also has that problem in store.

Recent examples have shown that Bitcoin experiences transferability problems when its network becomes too congested, which leads to slower confirmation times and higher transaction fees, and that creates limits on its ability to handle a large volume of transactions.

Bitcoin’s volatility makes it difficult for potential adopters to argue that Bitcoin possesses the honorific status of the ”store of value”.

Bitcoin faces severe regulatory issues

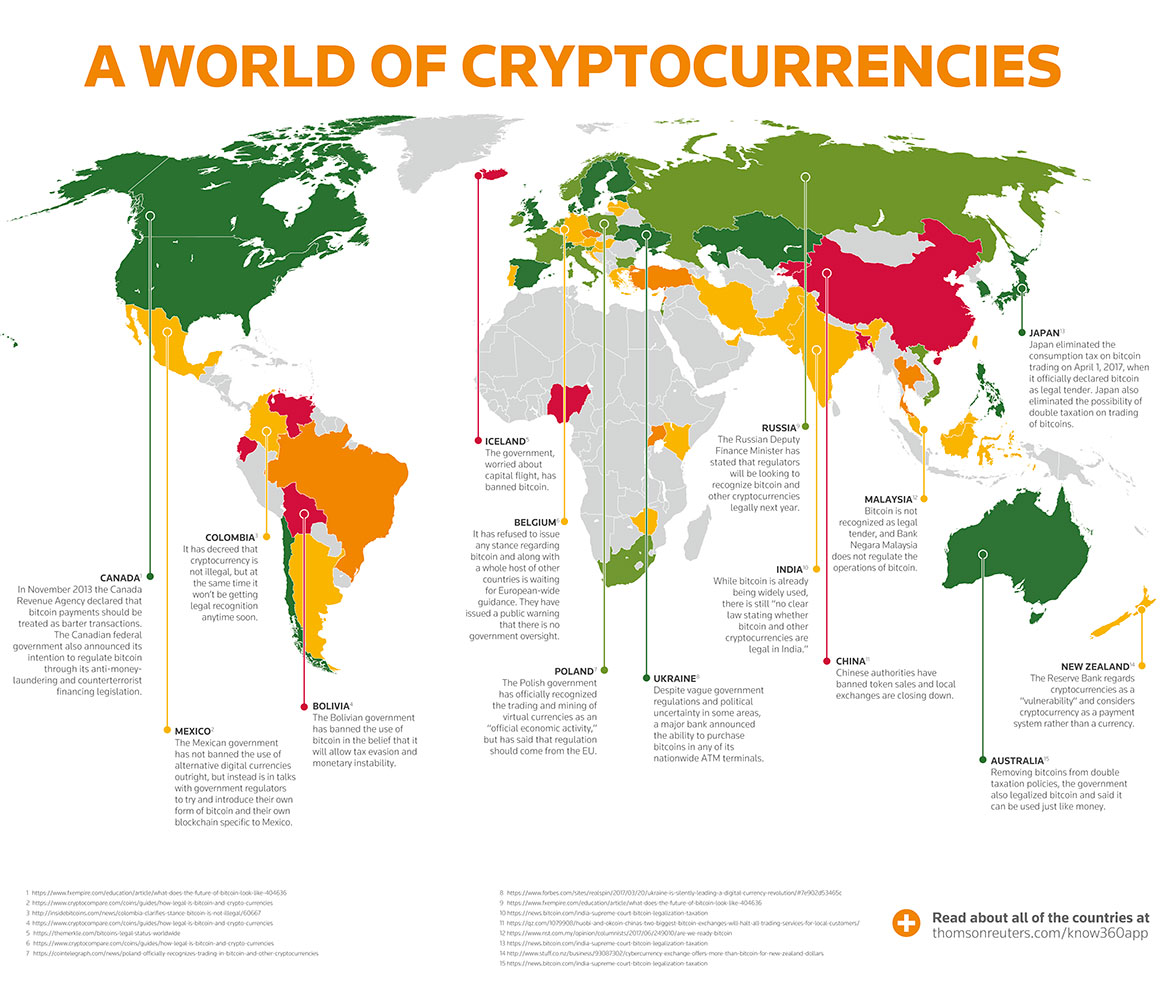

Lastly, The entire globe doesn’t have a consensus on how to regulate Bitcoin.

And that’s also another reason why the world shuns it. Regulatory acts usually affect its price, for example, when China started to accelerate its crackdown on Bitcoin in 2019 or when South Korea banned new cryptocurrency trading accounts in 2017.

When we take the US into the equation, we gain even more confusion, and one indicator of that is that the CFTC treats Bitcoin as a commodity while the IRS treats it as property.

The taxation of crypto is also a problem, according to the CEO of Node40, Perry Woodin, who said quote:

“It’s not possible to calculate your cryptocurrency tax liability without sophisticated software.”

Different US states created rules for smart contracts and initial coin offerings, while the federal government is still in relative inaction regarding Bitcoin regulation.

Several tokens even circumvented the regulation put in place. For example when China enacted a trading ban, which made exchanges start to get around it. And all those narratives eventually made eight countries, plus China, ban BTC altogether, a major blow to global Bitcoin adoption.

The post 3 reasons Why Bitcoin Didn’t Gain Mass Adoption Since Launch appeared first on CoinChapter.