In the world of cryptocurrencies, there are many different metrics. One of those metrics is known as “hash power” or “hash rate.” Ever wonder what the hash rate is? Hash rate is the measurement of your bitcoin’s processing power.

It’s a number that represents how many computing resources you’re contributing to help validate transactions on the Bitcoin network.

A cryptocurrency’s hashrate is an important indicator of how well its proof-of-work network may resist attacks by hackers. To ensure the security of their users, crypto platforms could stop trading or delist a currency if its network hashrate suddenly drops.

Moreover, for acquiring a stable and strong position in crypto investment, you need to learn the basics, like shorting crypto. Here is the shorting crypto guide 2022 for you. We’ll take you to step by step through the process of learning everything you need to know about hash rates and cryptocurrency mining.

What does hashrate mean?

A hashrate is a measurement of the speed at which your computer solves hashes and confirms transactions in a cryptocurrency network. Hashrates are typically reported in hash per second (H/s), kilo hashes per second (kH/s), and other units.

The hashrate of a particular network varies based on numerous factors, such as the trust people have in that currency. Max Keiser, a broadcaster and Bitcoin activist, has stated that an increase in hashrate shows a greater level of public confidence in the digital asset.

How Important Is Hash Rate?

Hash rate is a metric of the overall security and difficulty level of a blockchain network. As a blockchain network grows and more miners join its ranks, it becomes increasingly difficult for any one miner or group of miners to attack the ledger.

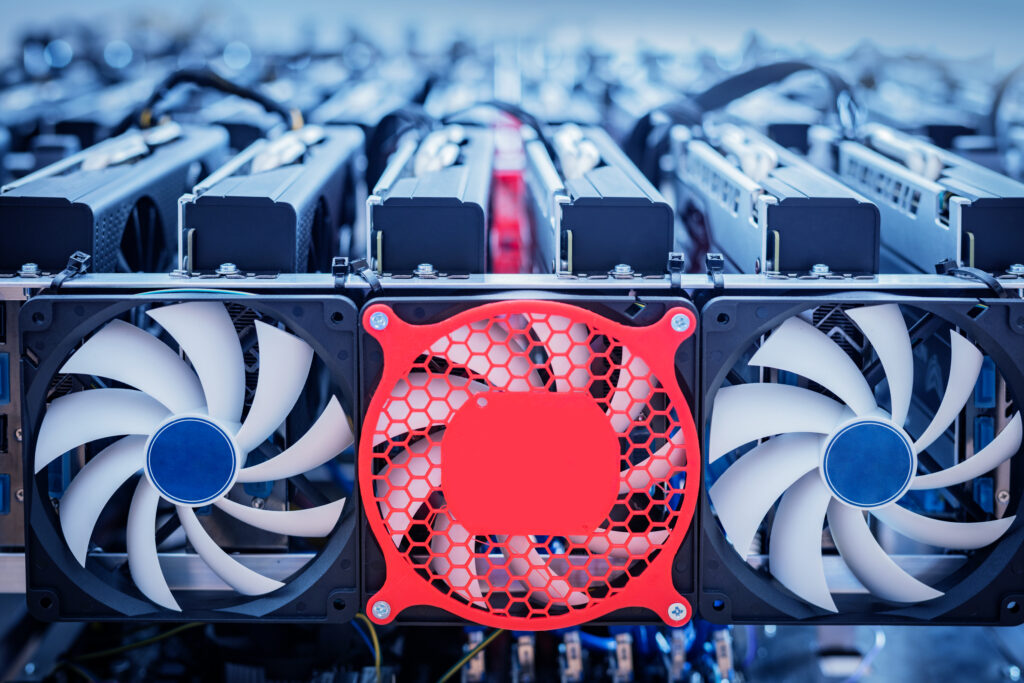

A high hashrate means that many computers are working to process transactions on the blockchain. This makes it possible for blockchains to protect themselves from people who might try to attack or mess with the network.

The network’s hashing power will increase as new computers join the network to mine blocks. The challenges of mining coins will increase as the system’s mathematical puzzles become more demanding.

Why does the hashrate fluctuate?

The hashrate is susceptible to a variety of factors, including the cryptocurrency that miners want to mine. Miners are economically motivated to mine cryptocurrencies that have a high value because mining requires costs.

Although a high hashrate suggests more competition, you can still reap profits. For example, although the Bitcoin hashrate could reach 179 exahashes per second (1 exahash is equal to 1 quintillion), miners are still encouraged because of their potential payout.

Mining is usually a business decision, and miners tend to choose coins that they believe will give them the best chance of making money. The Bitcoin system modifies the difficulty of mining new bitcoins every two weeks, according to the current hashrate.

The mining difficulty generally rises as the hashrate increases. The difficulty decreases when there is a significant drop in hashrate.

How does Hashrate Affect Mining Complexity?

The difficulty adjustment is one of the clever features of the Bitcoin protocol. The protocol dynamically adjusts the difficulty of mining Bitcoin in accordance with the current hash rate roughly every 2 weeks. When more miners are competing for the same amount of Bitcoin, it becomes harder to find each coin. As a result, mining difficulty rises. This process keeps Bitcoin profitable while also ensuring that there is only so much available at any given time.

What occurs if the Hash rate drops?

Lower hash rates tend to correlate with lower difficulty levels, indicating that fewer resources are necessary for a transaction to be verified. If the protocol were changed in this way, it might become easier for a group of miners to gain control of the network.

A cryptocurrency’s decentralization is an important factor in assessing its security. The more decentralized a network, the harder it is for malicious actors to disrupt the system and cause losses for users and investors.

To minimize losses, crypto platforms may freeze trading in a particular currency if its hashrate is dropping sharply.

Moreover, Margex is an online trading platform for digital currencies. It allows you to buy or sell the most popular cryptocurrencies, such as Bitcoin, Litecoin, Ethereum, etc., at any time and at the best available rate.

The post Everything You Need To Know About Hash Rate appeared first on CoinChapter.